Globe-spanning Brands as a Sign of Globalization

Literally, Hong Kong people have been soaked in the world of brands and fashion when regards are given to their lifestyles – you can see: gorgeous cars like Mercedes Benz and BMW running on vast highways; long queues lining up outside Louis Vuitton and Hermes shop along Canton Road; patrons in McDonald’s having their Coca Cola and tapping on their iPhone; families celebrating occasions in Disneyland; and students working on assignments with the aid of Google on their HP laptops…

In fact, the appearance of global brands has formed part of the identity of Hong Kong as a globalized city. More importantly, the footprints of the global brands as well as consumer recognition towards the brands imply the process of globalization.

Brand Recognition – what is it as a Global Indicator?

In essence, brand is the identity of a company, or precisely of a product or service. To have consumers recognise a brand, the owning company should equip the brand with an identity so distinctive that it becomes unique. The identity should also be a reason for patronage so as to be a means to the end of building customer loyalty. To make brand recognition easily comparable, brand equity can be another perspective of looking at it in light of loyalty and brand awareness (Aaker, 1996) .

In this blog, we made use of the “Best Global” annual report developed by Interbrand about rankings of global brands concerning brand equity and international management to see how brand recognition serves as a global indicator.

Interbrand was established in 1974 as a global brand consultancy. The "Best Global" is the annual report released by Interbrand on how the international brands manage their brand value.We have included data from 2007 to 2010 in our analysis. Each year, there are 100 global brands from different industries on the list of the report. We re-organized the brands on the list according to the sector they belong to and derived a chart showing the changes of brand value of different industries. Finally, based on the findings, we tried to investigate the relationship between globalization process and brand value.

Data Source: Interbrand

Chart 1: An Overview of Change in Brand Value from 2007 to 2010

One should note that here the change of brand value in an industry has a global significance as we grouped global brands originated from different countries together according to their industry. By doing so, we want to see how events happened in one country could impact the global economy as a whole.

From the above diagram, we can observe a stable increase in the brand value for beverages, electronics, luxury and restaurants industry. However, both automotive and financial services suffered huge drop in brand value from 2008 to 2009.

This was the time when financial tsunami attacked companies worldwide (Brutto, 2010) . Still at the forefront of our memory, the financial crisis was initiated in the U.S. by the bankruptcy of Lehman Brothers, which then influenced companies globally.

Data Source: (Interbrand, 2011)

Chart 2: Change in Brand Value of the Finance Services Sector from 2007 to 2010

Brand | Country of Origin |

American Express | |

J.P. Morgan | |

HSBC | |

Citi | |

Morgan Stanley | |

UBS |

Data Source: (Interbrand, 2011)

Table 1: Country of Origin of Financial Services Provider

The 2008 Financial Tsunami caused by the bankruptcy of Lehman Brothers brought about negative impacts all over the world. Even worse, it was revealed that the Lehman executives regularly used cosmetic accounting gimmicks at the end of each quarter to make its finances appear less shaky than they really were (Trumbull, 2010) . Most banks, including those prestigious in the minds of investors and the general public have expressed similar problems. Most were either under Government control or fighting off collapse. This greatly undermined customer confidence on financial services providers worldwide, leading to tremendous drop in brand value of major financial institutions especially investment banks which are renowned for and characterized by their “high-risk, high-return” characteristic. When most of the financial institutions have fallen short of the expectations of many, loss of confidence and trust in the whole industry is likely to be resulted.

The 2008 financial tsunami has disappointed millions of investors worldwide

Automotives

Harley-Davidson ( | 2007 | 2008 | 2009 | 2010 |

Ranking | 45 | 50 | 73 | 98 |

Change in brand Value | +0% | -1% | -43% | -24% |

Honda ( | 2007 | 2008 | 2009 | 2010 |

Ranking | 19 | 20 | 18 | 20 |

Change in brand Value | +6% | +6% | -7% | +4% |

Mercedes – Benz ( | 2007 | 2008 | 2009 | 2010 |

Ranking | 10 | 11 | 12 | 12 |

Change in brand Value | +8% | +9% | -7% | +6% |

Data Source: (Interbrand, 2011)

Table 2 – 4: Changes of Ranking and Brand Value of Automotives from 2007 to 2010

Harley Davidson had a disastrous year in 2008, having a drop of nearly half of its brand value

Economy is integrated as a whole (Chase-Dunn, Kawano, & Nikitin, p. 1) .

From the above two examples, we can see one important feature of globalized economy is the free flow of capital. When money can flow without the constraint of national borders, any change in one countries’ business environment, e.g. interest rate would trigger off significant influx or efflux of hot money and other capital investments. As a result, not only would the independencies among countries be increased, but the relationship of different industries operating around the world would also become more interdependent, which make the world’s economic system more complex than ever.

Brand Recognition Highlights International Management

In the Interbrand report, there are however sectors which could withstand the impact of global financial tsunami. It can then be worthwhile to scrutinize what contributed to such endurance in a bid to identify ways to manage globalization risks.

Data Source: (Interbrand, 2011)

For fast moving consumer goods (FMCG) industry, it suffered less impact from the financial crisis. The products sold in the industry are basic necessities and the brands included are highly globalized.

Thanks to the product nature, consumer demand for basic necessities that FMCG sells respectively are relatively inelastic: even the global economy is bad, people cannot delay their consumption of necessities to which hardly anything can substitute.

We can barely live without these brands

Data Source: (Interbrand, 2011)

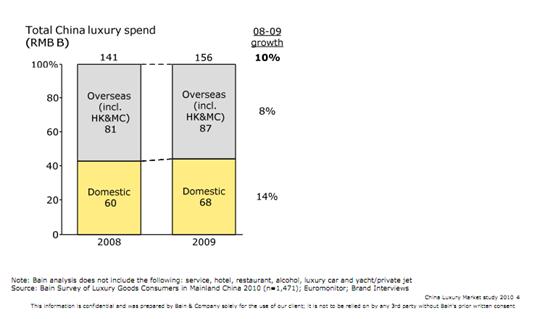

For luxury brands, it also suffered less harm compared to automotive industry. In the wake of the financial crisis, the pull is greatest in Asia and emerging economies (Brutto, 2010, p. 512) . The maintenance of brand values may be a result of the strong growth in the Asia market, especially the China market where the purchasing power of a great number of people was still kept at a high level and maintained its rising trend (having 26.6% growth in consumer expenditure and 27.5% growth in annual disposable income in 2008) (Euromonitor International, 2011) despite economic downturn worldwide.

Source: (Bain & Company, 2010, p. 4)

The increasingly wealthy middle class in China

Although fast-moving consumer goods and luxury products can be two very different sectors in terms of customer relationship management, positioning strategies and the marketing mix, especially price and people (, i.e. the services included in the offering and hence the premium customers are expected to pay), they exhibit one important commonality in the context of international management, that is consistency.

To be strong in the global economy in terms of a brand’s value in the eye of customers, the provision of consistent customer experience is vitally important. The main point here is that in order for brands to succeed globally, they have to clearly identify and present an image to the customers they serve so that they show a distinctive identity as the start of building customer loyalty and can secure their profitability during economic bad times. To this end, the most direct means is providing globally consistent customer experience.

Thanks to the product nature, the offerings of FMCG and Luxury Retail are innately standardized without much need for making adaptation because customers around the globe are ought to be sharing the same wishes: need for living from FMCG; and status symbol, Luxury Retail. As a result, brands coming from these two sectors can have more stable development of their brand value and hence, endurance to global economic depression.

Moreover, to maintain the consistency of customer experience worldwide, brands should be aware that “what it does in one country will impact how [customers] view its [offering] globally” (Cheng, 2010) . When a brand goes global successfully, its image is going to be recognized globally (that is what we discussed, the origin of global brand equity). With such an image, expectations from customers or other parties like competitors and even governments would be to a certain extent the same. This is one way of visualizing globalization.

Conculsion: Visualizing Globalization through Brands

When brand recognition goes further to become a symbol of national culture, expansion to global market may face political risks concerning cultural intrusion. Foreign governments who see the culture is conflictive to their local political structure may impose stringent regulations and scrutiny on the brands. Foreign political forces do not only impede a brand from extending its footprint by making the business environment prohibitively complex, but it also intervenes with the process of globalization. In this case, how the breath of brand recognition changes is certainly another way of visualizing globalization.

References

Aaker, D. (1996). Measuring Brand Equity Across Products and Markets. California Management Review .

Bain & Company. (2010, November). China Luxury Market study 2010. Retrieved February 6, 2011, from http://www.bain.com/bainweb/PDFs/cms/Public/China_Luxury_Market_Study_2010.pdf

Brutto, D. (2010, November). Globalization 4.0 and the New Logistics. Vital Speeches of the Day , p. 512.

Chase-Dunn, C., Kawano, Y., & Nikitin, D. (n.d.). Globalization: A World-Systems Perspective.

Cheng, J. (2010). Google stops Hong Kong auto-redirect as China plays harball.

Euromonitor International. (2011). China Statistics. Retrieved February 4, 2011, from Euromonitor International : http://www.euromonitor.com/factfile.aspx?country=CN

Hollis, N. (2009, Spring). Rethinking Globalization. Marketing research , pp. 12-18.

Interbrand. (2011). Retrieved Feburary 5, 2011, from Best Global Brands Ranking for 2010: http://www.interbrand.com/en/best-global-brands/best-global-brands-2008/best-global-brands-2010.aspx

Interbrand. (2011). Best Global Brands 2010. Interbrand.com.

KPMG. (2007). Luxury Brands in China. Hong Kong: KPMG.

Trumbull, M. (2010, March 12). Lehman Bros. used accounting trick amid financial crisis – and earlier. Retrieved February 4, 2011, from CSMonitor.com: http://www.csmonitor.com/USA/2010/0312/Lehman-Bros.-used-accounting-trick-amid-financial-crisis-and-earlier

沒有留言:

張貼留言